How Animals Risk Protection (LRP) Insurance Policy Can Protect Your Livestock Investment

In the realm of animals investments, mitigating threats is vital to making certain monetary stability and growth. Animals Threat Security (LRP) insurance stands as a reputable shield versus the unpredictable nature of the market, offering a calculated approach to guarding your properties. By diving right into the intricacies of LRP insurance coverage and its complex advantages, animals manufacturers can strengthen their investments with a layer of safety and security that transcends market variations. As we discover the world of LRP insurance coverage, its duty in safeguarding livestock investments becomes progressively noticeable, assuring a course towards sustainable monetary strength in an unpredictable sector.

Understanding Livestock Danger Defense (LRP) Insurance

Understanding Livestock Threat Protection (LRP) Insurance coverage is essential for livestock manufacturers looking to mitigate monetary dangers connected with rate changes. LRP is a government subsidized insurance coverage item created to safeguard manufacturers versus a drop in market value. By offering protection for market rate decreases, LRP assists producers secure a flooring price for their livestock, making sure a minimal degree of earnings no matter of market variations.

One secret element of LRP is its adaptability, enabling producers to personalize coverage levels and policy lengths to match their certain demands. Producers can select the variety of head, weight variety, protection cost, and insurance coverage duration that align with their manufacturing objectives and run the risk of resistance. Understanding these personalized alternatives is critical for manufacturers to efficiently manage their price risk direct exposure.

In Addition, LRP is offered for various livestock types, consisting of livestock, swine, and lamb, making it a functional danger management tool for animals manufacturers across different sectors. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make enlightened choices to secure their financial investments and make sure financial security when faced with market uncertainties

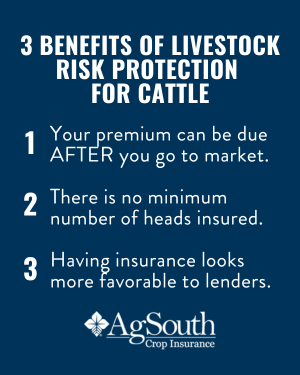

Advantages of LRP Insurance for Animals Producers

Livestock manufacturers leveraging Animals Risk Defense (LRP) Insurance coverage gain a tactical advantage in securing their financial investments from cost volatility and securing a secure financial footing among market unpredictabilities. One crucial advantage of LRP Insurance policy is rate protection. By establishing a flooring on the rate of their livestock, manufacturers can minimize the risk of substantial financial losses in the occasion of market declines. This allows them to intend their spending plans better and make informed decisions regarding their procedures without the continuous anxiety of price changes.

Furthermore, LRP Insurance gives producers with peace of mind. Overall, the advantages of LRP Insurance coverage for animals manufacturers are significant, offering a beneficial device for taking care of threat and making certain monetary security in an uncertain market atmosphere.

Just How LRP Insurance Mitigates Market Dangers

Alleviating market dangers, Animals Risk Security (LRP) Insurance coverage provides animals manufacturers with a dependable shield versus rate volatility and monetary uncertainties. By providing defense against unanticipated price declines, LRP Insurance coverage assists producers safeguard their financial investments and maintain monetary security in the face of market changes. This kind of insurance policy permits livestock producers to secure a rate for their animals at the start of the policy duration, ensuring a minimum price level no matter market changes.

Steps to Secure Your Livestock Investment With LRP

In the world of farming risk monitoring, carrying out Livestock Risk Defense (LRP) Insurance includes a tactical procedure to secure investments versus market changes and unpredictabilities. To safeguard your animals investment successfully with LRP, the initial step is to analyze the specific dangers your procedure faces, such as price volatility or unanticipated climate occasions. Comprehending these dangers allows you to determine the protection degree needed to safeguard your investment adequately. Next off, it is vital to study and pick a trustworthy insurance copyright that provides LRP plans customized to your livestock and company needs. Once you have actually picked a supplier, very carefully review the policy terms, conditions, and coverage restrictions to ensure they straighten with your risk monitoring goals. In addition, regularly keeping an eye on market patterns and adjusting your protection as required can help enhance your security against possible losses. By complying with these steps faithfully, you can improve the security of your animals investment and browse market unpredictabilities with confidence. click now

Long-Term Financial Safety And Security With LRP Insurance Coverage

Making certain withstanding monetary security via the usage of Animals Threat Defense (LRP) Insurance is a sensible long-term approach for agricultural manufacturers. By integrating LRP Insurance right into their risk monitoring plans, farmers can safeguard their animals investments versus unanticipated market variations and adverse occasions that can endanger their economic well-being with time.

One key advantage of LRP Insurance policy for long-lasting economic safety is the assurance it provides. With a trustworthy insurance coverage in position, farmers can minimize the economic risks connected with unpredictable market conditions and unanticipated losses due to factors such as condition episodes or all-natural disasters - Bagley Risk Management. This security enables manufacturers to focus on the everyday procedures of their livestock company without consistent stress over potential financial obstacles

Additionally, LRP Insurance policy provides a structured approach to managing danger over the long-term. By establishing details insurance coverage degrees and picking appropriate recommendation durations, farmers can customize their insurance coverage plans to straighten with their financial objectives and take the chance of resistance, making sure a safe and sustainable future for their livestock operations. To conclude, purchasing LRP Insurance is a positive strategy for agricultural manufacturers to achieve long-term financial protection and protect their incomes.

Final Thought

In conclusion, Animals Risk Security (LRP) Insurance policy is a beneficial device for animals manufacturers to mitigate market dangers and protect their financial investments. It is a smart option for guarding livestock investments.

Comments on “Protecting Success: Bagley Risk Management Provider”